Loading

Get Ok 22531-09 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK 22531-09 online

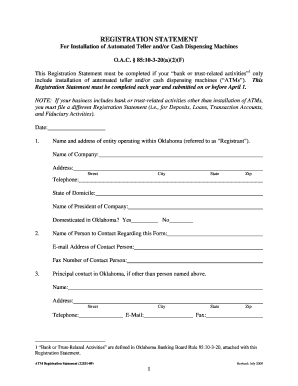

Filling out the OK 22531-09 form online is an essential step for entities involved in the installation of automated teller machines in Oklahoma. This guide will provide you with clear and detailed instructions on how to complete the form effectively.

Follow the steps to successfully complete the registration form.

- Click the ‘Get Form’ button to obtain the form and access it in an editable format.

- Provide the name and address of the entity operating within Oklahoma, referred to as 'Registrant'. You will need to fill out the following fields: Name of Company, Address (Street, City, State, Zip), Telephone, and State of Domicile.

- Enter the name of the President of the company and indicate whether the entity is domesticated in Oklahoma by selecting 'Yes' or 'No'.

- Identify the person to contact regarding this form by providing their name, email address, and fax number.

- If there is a principal contact in Oklahoma other than the person named above, include their name, address, telephone, email, and fax information.

- List all Oklahoma agencies, other than the Banking Department, with which the Registrant is licensed or registered.

- If the Registrant does not have offices in Oklahoma, provide the name and address of any agents or representatives conducting business in the state.

- Indicate the number of installed ATMs in Oklahoma.

- List the addresses of each ATM located in Oklahoma, attaching additional sheets if necessary.

- Sign and print your name at the designated areas, confirming your title as President, CEO, or other authorized officer.

- Make sure to include the fee of $50 per ATM (with a maximum of $500) payable to the 'Oklahoma State Banking Department' along with the registration form.

- Finally, submit the completed Registration Statement to the Oklahoma State Banking Department.

Begin the process of completing your OK 22531-09 form online today.

Yes, you can usually deduct franchise tax as a business expense on your federal tax return. This deduction can help reduce your overall taxable income. For specific guidance on claiming franchise tax in relation to your financial situation, consider consulting a tax professional familiar with OK 22531-09 regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.