Loading

Get Mo Int-4 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO INT-4 online

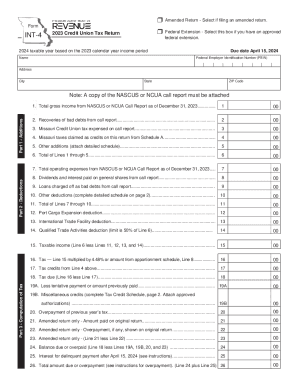

The MO INT-4 form is essential for credit unions filing their tax returns for the 2023 taxable year. This guide provides comprehensive, user-friendly instructions for completing the form online, ensuring accuracy and compliance. Follow these steps to navigate each section with ease.

Follow the steps to effectively complete the MO INT-4 form online.

- Press the ‘Get Form’ button to access the MO INT-4 document and open it in your online editor.

- Begin by filling in your name, address, city, state, ZIP code, and federal employer identification number (FEIN) at the top of the form. Ensure accuracy as these details are critical.

- In Part 1, report any additions by detailing the total gross income from the NASCUS or NCUA call report as of December 31, 2023. Make sure to complete all applicable lines as instructed.

- Proceed to Part 2 where you will input deductions. This includes deductions related to operating expenses, dividends, and interest paid.

- In Part 3, compute your taxable income by performing the necessary calculations based on your reported additions and deductions. Check that all lines have been accurately filled.

- Follow with calculating your tax, considering applicable rates and deductions mentioned in earlier sections.

- If applicable, make sure to complete the amended return section, detailing any previous payments and adjustments.

- Review all entries for accuracy and ensure that additional schedules, such as the Tax Credit Schedule, are attached if necessary.

- Once you are satisfied with the form's contents, proceed to save your changes, download a copy for your records, and/or print the filled document to submit.

Take the next step towards completing your filing by initiating the MO INT-4 form online today.

Missouri Tax Forms Missouri Form 1040 – Personal Income Tax Return for Residents. Missouri Form CRP – Certificate of Rent Paid. Missouri Form NRI – Nonresident/Part-Year Resident Income Percentage. Missouri Form PTS/PTC – Property Tax Credit. Missouri Form TC – Miscellaneous Income Tax Credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.