Loading

Get Mo Int-4 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO INT-4 online

Filling out the MO INT-4 form online can seem daunting, but this guide aims to simplify the process. Whether you are an experienced tax preparer or someone new to this task, these step-by-step instructions will help you navigate the form with confidence.

Follow the steps to successfully complete the MO INT-4 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

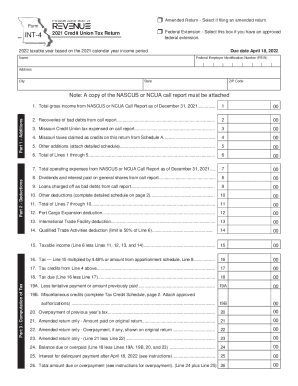

- Begin by selecting the appropriate checkboxes at the top of the form for 'Amended Return' or 'Federal Extension' if applicable. Make sure to attach any required documents if you choose these options.

- Fill in your name, Federal Employer Identification Number (FEIN), and address details including city, state, and ZIP code.

- Proceed to Part 1 and enter the total gross income from your NASCUS or NCUA Call Report for the relevant year, followed by recoveries of bad debts and the necessary deductions.

- In Part 2, list your operating expenses as indicated in the form, including dividends and interests paid on shares, and any other deductions that may apply.

- Calculate your taxable income using the provided lines which require you to subtract previous deductions from total additions.

- Compute your tax by applying the relevant tax rate to your taxable income, and account for any claimed tax credits.

- Finally, review the total balance due or overpayment, complete the declaration section, and ensure all required schedules and attachments are included.

- Once complete, save changes, download, print, or share the form as necessary before submission.

Complete your MO INT-4 form online and simplify your filing process today.

Missouri Tax Forms Missouri Form 1040 – Personal Income Tax Return for Residents. Missouri Form CRP – Certificate of Rent Paid. Missouri Form NRI – Nonresident/Part-Year Resident Income Percentage. Missouri Form PTS/PTC – Property Tax Credit. Missouri Form TC – Miscellaneous Income Tax Credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.