Loading

Get Mo Int-3 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO INT-3 online

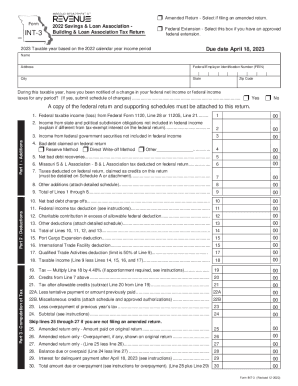

This guide provides a concise and supportive overview of how to complete the MO INT-3 form for the 2022 Savings & Loan Association Tax Return. Following these instructions will help users navigate each section and field efficiently.

Follow the steps to complete the MO INT-3 form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Identify whether you are filing an amended return or if you have an approved federal extension by selecting the appropriate box at the top of the form.

- Enter your basic information in the designated fields, including your name, address, Federal Employer Identification Number (FEIN), city, state, and zip code.

- Respond to the question regarding whether you have been notified of any changes to your federal net income or taxes during the taxable year by selecting 'Yes' or 'No.' If 'Yes,' be prepared to attach a schedule of changes.

- Proceed to Part 1 for Computation of Additions. Input amounts for each line based on your Federal Form 1120 or 1120S, including federal taxable income and other relevant sources of income and deductions.

- Continue to Part 2, where you will detail allowable deductions such as bad debts, federal income tax deductions, and other relevant deductions. Ensure to provide the necessary explanations and attachments.

- Move to Part 3 to calculate your overall tax liability by multiplying your taxable income by the applicable tax rate and including any credits from the previous lines.

- Complete the authorization and signature section confirming that all information provided is truthful and accurate.

- Finally, review your completed form for accuracy, save your changes, and download or print it for submission. Prepare to mail it to the specified address and make any necessary payments.

Start filling out the MO INT-3 form online now to ensure timely submission and compliance.

The IRS has general filing requirements for most taxpayers. Even if no tax is owed, most people file a return if their gross income is more than the automatic deductions for the year. The primary automatic deduction is the the standard deduction. Its amount will depend on your filing status and age.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.