Loading

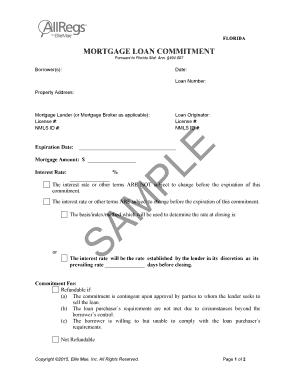

Get Fl Allregs Mortgage Loan Commitment 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL AllRegs Mortgage Loan Commitment online

Filling out the FL AllRegs Mortgage Loan Commitment is a crucial step in securing a mortgage in Florida. This guide will provide you with detailed instructions on how to complete the form online, ensuring that all necessary fields are filled accurately and efficiently.

Follow the steps to complete the FL AllRegs Mortgage Loan Commitment online.

- Click ‘Get Form’ button to access the form and open it for completion.

- Enter the borrower(s) information in the designated fields, including date and loan number. Ensure that all names are spelled correctly to avoid any future discrepancies.

- Provide the property address where the mortgage will be applied. Double-check for accuracy to ensure proper documentation.

- Input the mortgage lender's name or mortgage broker as applicable, along with their license number and NMLS ID number.

- Specify the expiration date of the commitment. This date is important as it establishes the time frame for acceptance by the borrower.

- Detail the mortgage amount and the interest rate as agreed upon. Be clear about whether the interest rate or other terms are subject to change before the commitment's expiration.

- Fill in the loan originator's information, including their license number and NMLS ID number.

- Indicate the basis, index, or method that will be utilized to determine the rate at closing.

- Complete the commitment fee section, indicating whether it is refundable or not based on the provided criteria.

- Specify the date by which the borrower must accept the commitment. Ensure to provide adequate time for review.

- Have all necessary parties, including co-borrowers, sign the document to acknowledge acceptance. Ensure that dates of signatures are included.

- Finally, save your changes, and consider downloading, printing, or sharing the completed form as necessary.

Complete your mortgage paperwork efficiently by filling out the FL AllRegs Mortgage Loan Commitment online today.

The average 30-year fixed refinance APR is 7.25%, ing to Bankrate's latest survey of the nation's largest mortgage lenders. On Monday, February 26, 2024, the national average 30-year fixed mortgage APR is 7.32%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.