Loading

Get Corporate Farmer Commodity Wages - Pik 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Corporate Farmer Commodity Wages - PIK online

Filling out the Corporate Farmer Commodity Wages - PIK form can seem daunting, but with clear instructions, it becomes manageable. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully complete the Corporate Farmer Commodity Wages - PIK form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

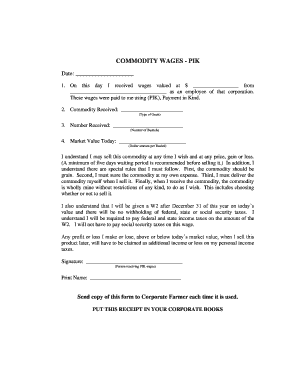

- In the first section, enter the date on which you are filling out the form.

- Next, indicate the wages you received as an employee of the corporation. Enter the dollar amount of wages in the space provided.

- In the following field, state the name of the corporation from which you received the wages.

- Specify the type of grain that you received as payment in kind (PIK) under 'Commodity Received'.

- Enter the number of bushels you received in the 'Number Received' section.

- Provide the current market value per bushel in the 'Market Value Today' field.

- Review the information you have entered to ensure accuracy before proceeding.

- Sign the form in the designated area and print your name below your signature.

- Finally, save changes, download, print, or share the completed form as required.

Start completing your Corporate Farmer Commodity Wages - PIK form online today!

The employer must report the fair market value of the commodity on form W-2 at the end of the year. The fair market value to appear on the W-2 is the value on the date of transfer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.