Loading

Get Oh Ec99-1 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH EC99-1 online

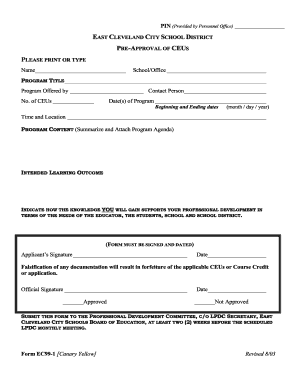

This guide provides a comprehensive overview of how to fill out the OH EC99-1 form online. It is designed to assist users in completing the form accurately and efficiently, ensuring a smooth submission process.

Follow the steps to complete the OH EC99-1 form online.

- Click ‘Get Form’ button to obtain the OH EC99-1 form and open it in the editor.

- Print or type your name in the designated field to clearly identify yourself as the applicant.

- Enter the name of your school or office in the appropriate section to indicate where you are affiliated.

- Provide the program title in the dedicated field to identify the training or educational session you are seeking approval for.

- Fill in the name of the program provider, as well as the contact person associated with the program.

- Indicate the number of Continuing Education Units (CEUs) you expect to earn upon completion of the program.

- Document the dates of the program, which includes both the beginning and ending dates formatted as month/day/year.

- Specify the time and location of the program to help the reviewers understand when and where it will take place.

- Summarize the program content and attach the program agenda to provide a detailed overview of what the training will cover.

- Clearly define the intended learning outcomes that you aim to achieve through participation in the program.

- Explain how the knowledge gained will support your professional development, addressing the needs of educators, students, schools, and the district.

- Sign and date the form, ensuring that all information is accurate before submission.

- Submit the completed form to the Professional Development Committee at least two weeks before the scheduled monthly meeting for review.

Begin filling out your OH EC99-1 form online today for timely submission!

When filling out a W-9 for a tax-exempt organization, ensure that you include the organization's name, address, and tax identification number. Confirm that you indicate the organization's exempt status accurately. Knowledge of OH EC99-1 can guide you in ensuring compliance while handling tax-related forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.