Loading

Get Days After Completion (including Signature) By The Borrower, Completion Of The 4506-

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Days After Completion (including Signature) By The Borrower, Completion Of The 4506- online

This guide provides step-by-step instructions on filling out the Days After Completion (including Signature) By The Borrower, Completion Of The 4506- form online. It aims to help users navigate the process efficiently and effectively.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the required form and open it in your online editing tool.

- Review the first section of the form, which typically requires your identifying information, including your name and Social Security number. Make sure to enter this information accurately.

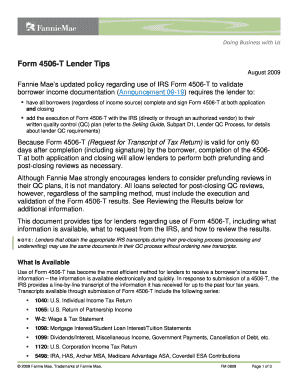

- In the section requesting the type of transcripts required, indicate the specific tax forms needed — such as 1040, W-2, or 1099 — based on your income documentation.

- Fill in the duration for which you are requesting the transcripts. Be aware that the IRS provides transcripts for up to four years, so choose accordingly.

- Complete the signature section by entering your name as it appears on your tax return and date the form. Ensure your signature complies with IRS requirements if the form is prepared for submission.

- After confirming that all information is correct, you can save the changes, download the form, or print it for your records.

Complete your documents online for seamless processing.

Form 4506-T is free, and transcripts generally arrive in about three weeks. When you file the Form 4506-T, you'll receive a printout of most of the line items on your tax return (rather than a copy of the actual return). This document is called a tax return transcript.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.