Loading

Get Filed For A Tin For Your Trust, Call The Irs Or Visit Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Filed For A TIN For Your Trust, Call The IRS Or Visit Irs online

This guide provides step-by-step instructions on filling out the Filed For A TIN For Your Trust form. Proper completion of this form is essential to ensure compliance with IRS regulations and to facilitate the setup of your trust's Tax Identification Number (TIN).

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

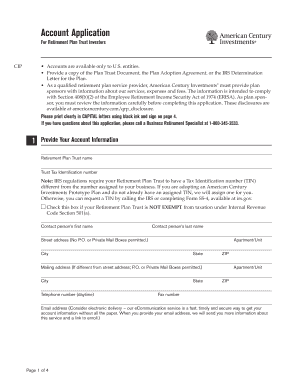

- Provide your account information by entering the Retirement Plan Trust name and Trust Tax Identification Number. Ensure that the TIN is distinct from any business numbers assigned to you. If you do not have an assigned TIN, be prepared to call the IRS or complete Form SS-4 to request one.

- Indicate the type of plan by selecting only one option from the given categories (e.g., 401(k), profit sharing).

- List all trustees authorized to direct transactions on the accounts under the Trust TIN. Provide each trustee's name, title, Social Security number, date of birth, and signature.

- Outline your investment instructions by specifying the initial investments in the appropriate funds. Ensure you include amounts and fund names. If you wish to set up automatic monthly investments, provide the relevant start date and amount for each fund.

- Review the services available to you. Indicate if you would like a book of checks if your selected fund offers CheckWriting.

- Sign and date the application. Ensure all trustees have reviewed the application and signed it according to their names as listed earlier. This includes providing necessary certifications and ensuring the correct taxpayer identification number is reported.

- Once completed, save changes, and download or print the form to keep a copy for your records.

Start filling out your document online today for a smooth process.

Remember, you will be contacted initially by mail. The IRS will provide all contact information and instructions in the letter you will receive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.