Loading

Get Tax Computation Schedule - Kentucky: Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAX COMPUTATION SCHEDULE - Kentucky: Department Of Revenue online

Filling out the Tax Computation Schedule is a crucial step in ensuring that your taxes are calculated accurately. This guide will provide you with clear, step-by-step instructions to effectively complete this form online, enabling you to navigate the process with ease.

Follow the steps to complete your Tax Computation Schedule online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

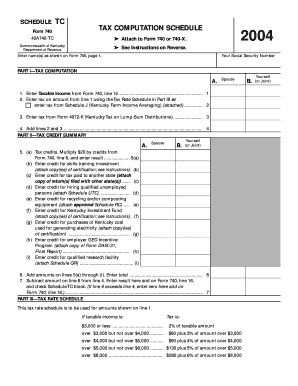

- Enter your name(s) and Social Security Number as shown on Form 740, page 1.

- In Part I – Tax Computation, begin by filling in the taxable income from Form 740, line 15 on line 1.

- Using the Tax Rate Schedule in Part III, calculate the tax based on the amount from line 1 and record it on line 2. If applicable, enter the tax amount from Form 4972-K on line 3.

- Add the amounts from lines 2 and 3 and place the total on line 4.

- In Part II – Tax Credit Summary, calculate your tax credits. For line 5(a), multiply $20 by the number of credits from Form 740, line 8 and enter the result.

- Complete lines 5(b) through 5(i) by entering the corresponding credits as instructed, ensuring to attach necessary documentation.

- Total the amounts from lines 5(a) through 5(i) and record the sum on line 6.

- Subtract the total from line 6 from the amount on line 4 and enter the result on line 7. If line 6 exceeds line 4, enter zero on line 7.

- Review all entered information for accuracy. Once finalized, save your changes, and choose to download, print, or share the completed form as needed.

Start completing your Tax Computation Schedule online today!

Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2022. The tax rate is four and one-half (4.5) percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141.019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.