Loading

Get Application For Cemetery Property Tax Exemption For - Hcad

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Cemetery Property Tax Exemption For - Hcad online

This guide provides clear and detailed instructions to assist users in completing the Application For Cemetery Property Tax Exemption For - Hcad online. By following these steps, you can effectively navigate the form to ensure you correctly claim your property tax exemption.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to access the form and open it in your editor.

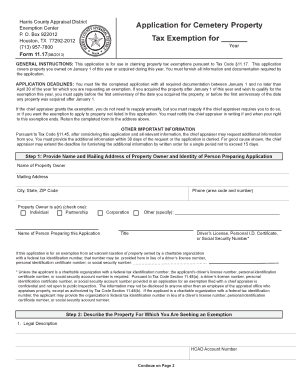

- In the first section, provide the name and mailing address of the property owner. Indicate the identity of the person preparing the application by checking the appropriate box as either an individual, partnership, or corporation. Include the phone number and specify other which may apply.

- Next, describe the property for which you are seeking an exemption. Provide the legal description and the HCAD account number. Answer the questions confirming if the property is used exclusively for human burial and if it is being held for profit, checking 'yes' or 'no' as applicable.

- In the final section, read the statement carefully, then sign and date the application. Ensure you are authorized to sign on behalf of the property owner, providing their title if needed.

- Once you have completed the form, you can save your changes and consider options to download, print, or share the form to complete your submission.

Start your application for cemetery property tax exemption online today!

Sec. 11.17. CEMETERIES. A person is entitled to an exemption from taxation of the property he owns and uses exclusively for human burial and does not hold for profit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.