Loading

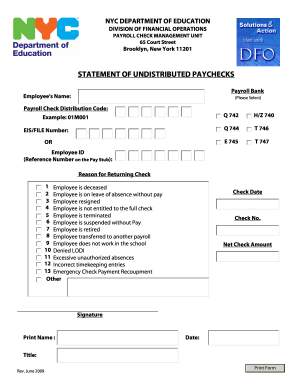

Get Ny Statement Of Undistributed Paychecks 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Statement of Undistributed Paychecks online

The NY Statement of Undistributed Paychecks is a crucial document for addressing unclaimed payroll checks. This guide will provide clear and supportive instructions to help users fill out the form online effectively.

Follow the steps to complete your form with ease.

- Press the ‘Get Form’ button to access the form and open it within the applicable online editor.

- Begin by selecting the employee's name from the provided dropdown menu.

- Enter the payroll check distribution code, if applicable, using the example format (e.g., 01M001) as guidance.

- Input the EIS/FILE number or employee ID as indicated on the pay stub; ensure accuracy for correct identification.

- Indicate the reason for returning the check by selecting one of the provided options, such as 'Employee is deceased' or 'Employee is on leave of absence without pay'.

- Fill in the check date and check number precisely as they appear on the original document.

- Enter the net check amount to reflect the total sum being addressed in this statement.

- Ensure to sign the form in the designated signature area, indicating your approval and completion of the document.

- Print your name clearly beneath your signature, along with the date of completion.

- Indicate your title, confirming your authority to submit this form.

- Once all fields are completed, save any changes made to your document. You may also download, print, or share the form as needed.

Complete your documents online today for a seamless process!

The income tax rate for businesses in New York varies depending on the size and type of the business. Generally, smaller businesses may benefit from lower rates compared to larger corporations. Understanding the applicable tax rates is crucial when assessing the implications of your NY Statement of Undistributed Paychecks and making informed fiscal decisions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.