Loading

Get Form 8379 (rev. January 2006) (fill-in Capable)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

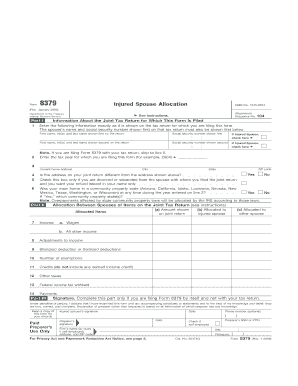

How to fill out the Form 8379 (Rev. January 2006) (Fill-In Capable) online

Filling out Form 8379 can seem complex, but with the right guidance, the process can be straightforward. This form is designed for the injured spouse allocation and can be filled out online efficiently.

Follow the steps to fill out the form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Provide the required information in Part I. Enter the first spouse's name and social security number as shown on the tax return. If you are the injured spouse, check the appropriate box.

- Fill in the details of the second spouse's name and social security number in the designated fields, ensuring accuracy.

- Enter the tax year for which you are filing this form in the specified line.

- Complete the current home address fields including city and ZIP code.

- Indicate whether the address on your joint return differs from your current address. Check the box if you are divorced or separated and wish to receive the refund in your name only.

- Answer the questions regarding community property states and provide any applicable details.

- Proceed to Part II to allocate items on the joint tax return. List allocated items such as income, adjustments, deductions, and taxes separately for both spouses.

- Fill in the signature section if you are filing Form 8379 alone, ensuring all necessary boxes are checked, and the information is completed accurately.

- Review your completed form for accuracy before saving your changes or printing it for submission.

- Finally, take the appropriate action to save, download, print, or share the filled form, ensuring you have a copy for your records.

Start filling out your Form 8379 online today to manage your tax refunds effectively.

Purpose of Form Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past-due obligation of the other spouse. By filing Form 8379, the injured spouse may be able to get back his or her share of the joint refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.