Get India Hdfc Bank Dematerialisation Request Form 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India HDFC Bank Dematerialisation Request Form online

This guide provides clear and comprehensive instructions for users to effectively fill out the India HDFC Bank Dematerialisation Request Form online. Whether you are familiar with the dematerialisation process or a first-time user, this step-by-step approach ensures accuracy and ease in completing your request.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the Dematerialisation Request Form, which will open in your editor.

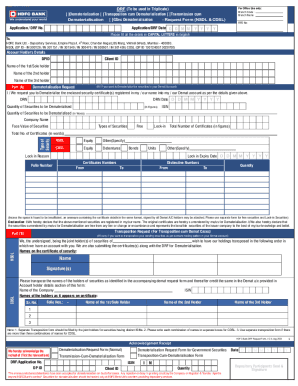

- Enter the application or DRF number in the designated field to identify your request.

- Fill in the application/DRF date using the format DD/MM/YYYY to indicate when you are submitting the form.

- Complete the Account Holder's Details section. Enter your DPID and Client ID, and provide the full names of the first, second, and third holders. Ensure that all details are written in capital letters.

- In the Dematerialisation Request section, indicate your request to dematerialise enclosed security certificates by checking the relevant box.

- Provide the date of DRN and the quantity of securities to be dematerialised, both numerically and in words, ensuring the figures are accurate.

- Specify the ISIN, company name, and face value of the securities. Select the type of securities and indicate if they are free or lock-in.

- List the total number of certificates in both figures and words. Include specific details about distinctive numbers and folio number, if applicable.

- Read and agree to the declaration, confirming that the securities are registered in your name and free from any liens or encumbrances.

- If applicable, fill out the Transposition Request section, providing necessary details if you wish to change the order of holders.

- Complete the Transmission-Cum-Dematerialisation Request with accurate information if you are transmitting securities following the death of a holder.

- For Government Securities, complete Part D appropriately, including necessary confirmations if submitting physical securities.

- Review the entire form for accuracy, then save your changes. You may download, print, or share the completed form as needed.

Take the next step towards managing your investments effectively by completing the India HDFC Bank Dematerialisation Request Form online!

Related links form

Step 1: Contact your DP for a dematerialisation request form (DRF). Step 2: Fill in all the requested details in the DRF form and submit it along with the physical share certificates to your Depository Participant. You also need to mention the phrase 'Surrendered for Dematerialisation' on each share certificate.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.