Loading

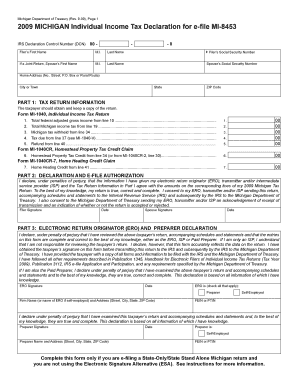

Get 9-09), Page 1 2009 Michigan Individual Income Tax Declaration For E-file Mi-8453 Irs Declaration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 9-09), Page 1 2009 MICHIGAN Individual Income Tax Declaration For E-file MI-8453 IRS Declaration online

Completing the 2009 Michigan Individual Income Tax Declaration for e-file MI-8453 is an essential part of submitting your state income tax return electronically. This guide provides clear, step-by-step instructions to help you accurately fill out the form online.

Follow the steps to effectively complete the MI-8453 form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- At the top of the form, fill in your first name, middle initial, last name, and if applicable, your spouse's first name, middle initial, and last name.

- Enter your Social Security number and your spouse's Social Security number, if you're filing jointly.

- Fill out your home address, including the street number, street name, city, state, and ZIP code.

- In Part 1, input the relevant tax return information. This includes your total federal adjusted gross income, total Michigan income tax, and Michigan tax withheld, each taken from the corresponding lines of your MI-1040 form.

- Also in Part 1, record the amounts for tax due, refund, Homestead Property Tax Credit, and Home Heating Credit as per their respective lines.

- In Part 2, sign the declaration, confirming that the information you provided is true and correct to the best of your knowledge. Enter the date next to your signature.

- If applicable, have your spouse sign and date the form as well.

- In Part 3, if you are the electronic return originator (ERO) or paid preparer, complete the required information including your signature and date.

- Once the form is complete, save your changes and consider downloading or printing a copy for your records.

- Finally, if you are filing your return online, ensure that you mail the completed Form MI-8453 to the Michigan Department of Treasury within three business days after receiving acknowledgment of your e-filed return.

Complete your tax declaration and submit it online today.

Michigan will retrieve and acknowledge IIT e-file returns on the same day the IRS opens for e-file. E-filing and choosing Direct Deposit is the fastest way to receive your Michigan refund. Michigan and City of Detroit tax returns for 2021, 2022 and 2023 tax returns will be accepted during the 2024 processing year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.