Loading

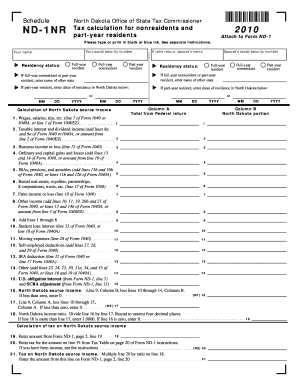

Get 1040a, Or Line 1 Of Form 1040ez)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040A, or Line 1 of Form 1040EZ online

Completing tax forms online can streamline the filing process and ensure accuracy. This guide provides a step-by-step approach to filling out the 1040A or Line 1 of Form 1040EZ, making it accessible for users of all experiences.

Follow the steps to accurately fill out your tax form online.

- Click ‘Get Form’ button to retrieve the form and open it in your editor.

- Fill in your personal information at the top of the form. Provide your name and social security number, ensuring accuracy to avoid delays.

- Indicate your residency status. Select 'Full-year resident', 'Full-year nonresident', or 'Part-year resident'. If applicable, enter the name of any other state where you resided.

- For part-year residents, complete the section detailing the dates of your residency in North Dakota.

- Moving ahead to Column A, input the total income figures from your federal return, ensuring that all entries are reflective of the amounts reported on your federal forms.

- Proceed to complete Column B by detailing the North Dakota portions of your income according to the instructions laid out for each respective line. Be careful to follow each line's directions for accuracy.

- After entering all necessary data, review the entire form for accuracy. Check to confirm that all information is complete before proceeding to save.

- Once satisfied with your entries, you can save your changes, download the form for your records, print it out, or share it as necessary.

Start completing your 1040A or Line 1 of Form 1040EZ online today for a hassle-free tax filing experience.

Form 1040A Eligibility Requirements Your taxable income was less than $100,000. Your income came only from wages, interest and dividends, capital gains distributions, taxable scholarships and grants, unemployment benefits, Alaska Permanent Fund dividends, pensions, annuities and IRAs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.