Loading

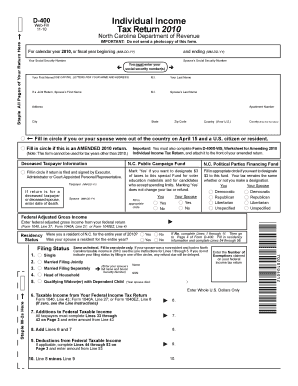

Get 4 Web-fill 11-10 Staple All Pages Of Your Return Here North Carolina Department Of Revenue &quot

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4 Web-Fill 11-10 Staple All Pages Of Your Return Here North Carolina Department Of Revenue online

Filing your North Carolina Individual Income Tax Return (D-400) can seem complex, but this guide will walk you through the process step-by-step. Follow along to ensure that you accurately complete each section of the 4 Web-Fill 11-10 form.

Follow the steps to confidently complete your tax return.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Fill in your personal information: Enter your first name, middle initial, and last name using capital letters. If you are filing jointly, also provide your spouse's information.

- Provide your social security number and that of your spouse in the designated fields.

- List your address, including apartment number (if applicable), city, state, zip code, and country if not the U.S.

- Indicate if either you or your spouse were out of the country on April 15 by filling in the appropriate circle.

- If this is an amended return, fill in the circle to indicate that.

- For deceased taxpayers, enter the date of death for the relevant taxpayer or spouse, noting that this is necessary for proper filing.

- Complete the residency status questions regarding whether you and your spouse were residents of North Carolina for the entire year.

- Provide your federal adjusted gross income as reported on your federal tax return.

- Determine your filing status by filling in one circle corresponding to your federal tax return's status.

- Proceed to complete lines 33 through 43 on Page 3 as instructed and enter the amount from Line 43.

- Complete the computation of North Carolina taxable income and any applicable deductions or credits as outlined in the form.

- Ensure you staple all pages and any required documents, such as W-2 forms, to the completed return.

- Sign and date the return, and ensure your spouse also signs it if filing jointly.

- Finally, save your changes, download, print, or share the completed form as necessary.

Take action now to file your North Carolina income tax return online!

You may check the status of your refund online using our Where's My Refund? web service, or you may call our refund inquiry line toll-free at 1-877-252-4052.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.