Loading

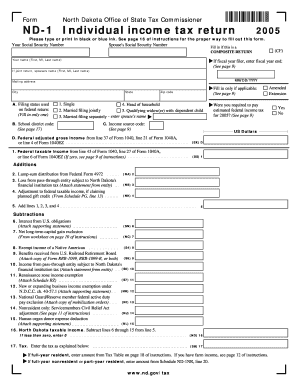

Get Spouse 's Social Security Number Your Social Security Number Fill In If This Is A Composite Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Spouse's Social Security Number Your Social Security Number Fill In If This Is A Composite Return online

Filing your composite tax return can feel overwhelming, especially when you're required to provide specific information like Social Security numbers. This guide offers clear, step-by-step instructions to help you effectively complete the Spouse's Social Security Number section and ensure your tax filing is accurate.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Locate the section labeled 'Spouse's Social Security Number' on the form. This field is critical for identification purposes when filing a composite return. Ensure that you have the correct Social Security number for your partner at hand.

- Next, proceed to the 'Your Social Security Number' section. Enter your own Social Security number accurately, as this information will be used to link your tax records.

- If this is a composite return, it's essential to mark this section accordingly. This indicates that the return combines income from both you and your partner.

- Continue to fill out all other sections of the form as required, ensuring that all information is entered clearly, following instructions for each section.

- Once you have completed the form, review all entered information for accuracy. Check that all Social Security numbers are correct and that no fields are left blank.

- Finally, save your changes, and proceed to download, print, or share the completed form as necessary.

Start completing your documents online today for a smooth filing experience.

Unfortunately, you can't file single if married to a nonresident alien (NRA). Once you tie the knot, you must either go with Married Filing Separately or Married Filing Jointly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.