Loading

Get Read Instructions For Form 502cr - Maryland Tax Forms And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Read Instructions For Form 502CR - Maryland Tax Forms And Credits online

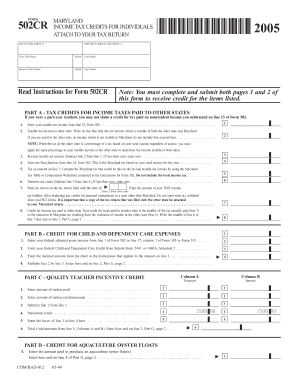

Filing your taxes can feel overwhelming, but understanding how to fill out Form 502CR for Maryland Tax Credits is essential. This guide provides a clear and supportive approach to help you complete the form accurately and efficiently.

Follow the steps to complete your Form 502CR online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by entering your name and social security number in the designated fields. Ensure that you enter the information as it appears on your tax return.

- In Part A, input your taxable net income from line 22 of Form 502. Then, enter the taxable net income from other states, being careful to exclude any income not taxable in Maryland.

- Calculate the revised taxable net income by subtracting the amount from line 2 from line 1. If the result is less than zero, enter zero.

- Enter the Maryland tax calculated from line 24 of Form 502, representing your total income tax for the year.

- Next, compute the tax owed based on your revised taxable net income using the Maryland Tax Table or the Computation Worksheet, ensuring you do not include local income taxes.

- Subtract the calculated tax on line 5 from the tax on line 4 to find your tentative tax credit. If this is less than zero, enter zero.

- In Part B, enter your federal adjusted gross income from line 1 of Form 502 or the corresponding line from Forms 505 or 515.

- Continue with Part G, where you will summarize the credits from previous parts, entering the appropriate amounts.

- Finally, save your changes and either download, print, or share the completed form as needed.

Complete your tax documentation online to ensure a smooth filing process.

You may need to file Form 1040-NR if you: Were a nonresident alien engaged in a trade or business in the United States. Represented a deceased person who would have had to file Form 1040-NR. Represented an estate or trust that had to file Form 1040-NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.