Loading

Get Tax Status Form - State Council Of Higher Education For Virginia - Schev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Status Form - State Council Of Higher Education For Virginia - Schev online

This guide provides step-by-step instructions on how to accurately complete the Tax Status Form for the State Council of Higher Education for Virginia (Schev) online. Following these guidelines will ensure you fill out the form correctly and efficiently.

Follow the steps to complete the Tax Status Form online.

- Press the ‘Get Form’ button to access and open the Tax Status Form in your online editor.

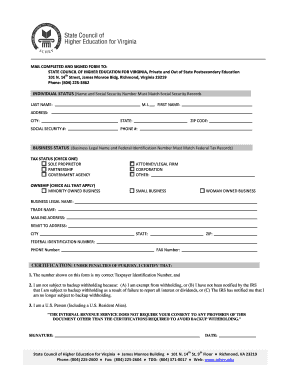

- Begin filling in the individual status section. Ensure that your last name, middle initial, and first name are accurately entered. Provide your complete address, city, state, zip code, social security number, and phone number.

- Move to the business status section. Here, you will need to input your business legal name and federal identification number. Confirm that this matches your federal tax records.

- Select one tax status by checking the appropriate box: sole proprietor, partnership, government agency, attorney/legal firm, corporation, or other.

- Next, indicate ownership by checking all applicable boxes such as minority owned business, small business, and woman owned business.

- Complete the business legal name, trade name, mailing address, remit to address, city, federal identification number, as well as phone and fax numbers.

- In the certification section, read the statements carefully. By signing, you confirm the accuracy of the taxpayer identification number, your exemption status from backup withholding, and your status as a U.S. person or U.S. resident alien.

- Finalize the form by providing your signature and the date. Ensure all information has been reviewed for accuracy.

- After completion, you can save your changes, download a copy of the form for your records, print it for mailing, or share it as needed.

Complete your Tax Status Form online today to ensure timely processing of your documentation.

Resident -- A person who lives in Virginia, or maintains a place of abode here, for more than 183 days during the year, or who is a legal (domiciliary) resident of the Commonwealth, is considered a Virginia resident for income tax purposes. Residents file Form 760.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.