Loading

Get No Income Tax Return Submitted

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the No INCOME Tax Return Submitted online

Filling out the No INCOME Tax Return Submitted form can seem challenging, but with clear guidance, you can navigate the process smoothly. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

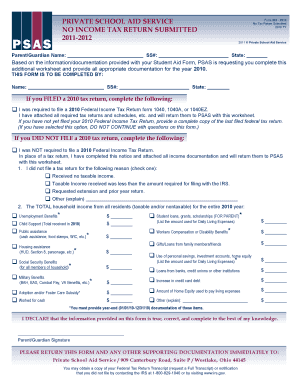

Follow the steps to complete the No INCOME Tax Return Submitted form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the parent or guardian in the designated field. Ensure the name is spelled correctly.

- Provide the social security number (SS#) and state of residency in the allocated fields. Double-check for accuracy.

- If you filed a 2010 tax return, mark the appropriate checkbox and gather all necessary tax returns and schedules to attach with this worksheet.

- If you did not file a 2010 tax return, select the correct checkbox indicating that you were not required to file, and complete the section explaining why you did not file.

- Detail your total household income from all residents for the entire 2010 year by filling in the relevant fields based on the sources of income, marking the checkboxes for each applicable category.

- Provide dollar amounts for each source of income listed, ensuring that you have documentation for any applicable items marked with an asterisk.

- At the bottom of the form, read the declaration statement and ensure that your information is true and complete; then, sign and date the form.

- Make sure to save your changes, download or print the completed form, and prepare to return it along with any supporting documentation to Private School Aid Service.

Complete your document submissions online today to ensure a smooth application process.

Verification of non-filing letter - states that the IRS has no record of a processed Form 1040-series tax return as of the date of the request. It doesn't indicate whether you are required to file a return for that year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.