Loading

Get Form It-135

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-135 online

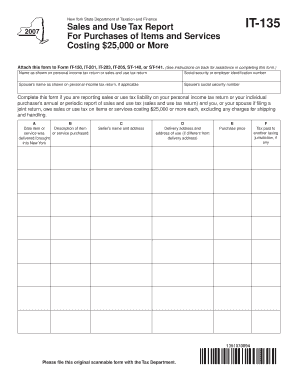

Filling out the Form IT-135 is an essential step for reporting sales and use tax on purchases of items and services costing $25,000 or more. This guide will provide you with clear, step-by-step instructions to navigate the online process effectively.

Follow the steps to successfully complete Form IT-135 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as shown on your personal income tax return or sales and use tax return in the designated field.

- Input your Social Security number or Employer Identification Number (EIN) accurately in the specified section.

- If applicable, provide your spouse’s name and Social Security number as shown on their personal income tax return.

- Record the date the item or service was purchased in the relevant section, ensuring accuracy for tax records.

- Describe the item or service that was purchased by providing sufficient details for clarity.

- Fill in the seller’s name and address, including the Internet address if the purchase was made online.

- Enter the delivery address and the address where the item or service will be used, if they are different from the delivery address.

- Provide the purchase price in the designated field, ensuring that it excludes any shipping and handling charges.

- If applicable, indicate any tax paid to another taxing jurisdiction in the corresponding section.

- Review all entered information for accuracy and completeness.

- Once satisfied with the form, save changes, and proceed to download, print, or share the completed form as needed.

Start completing your Form IT-135 online today for a seamless tax reporting experience.

Basically, you are allowed earn up to $15,000 tax free in the tax year if 90% or more of your total income was sourced in Canada. If you earned more than 10% outside Canada, you won't be eligible to earn any tax free income up to a total amount of $15,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.