Loading

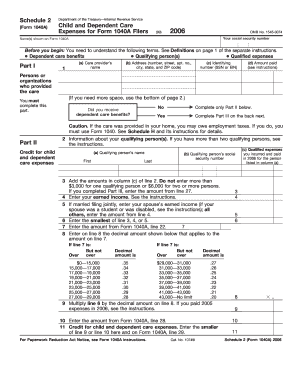

Get 2006 Form 1040a (schedule 2) (fill-in Capable). Child And Dependent Care Expenses For Form 1040a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Form 1040A (Schedule 2) (Fill-In Capable). Child And Dependent Care Expenses For Form 1040A online

This guide provides an expert analysis and step-by-step instructions for filling out the 2006 Form 1040A (Schedule 2) associated with child and dependent care expenses. Designed for users with varying levels of experience, this document will help you navigate through the form efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number in the designated field at the top of the form. This information is essential for identification purposes.

- Provide your name and the names of your partner, if applicable, as shown on Form 1040A.

- In Part I, list the care provider's name, address, identifying number (either their social security number or employer identification number), and the amount you paid for care services.

- Indicate whether you received any dependent care benefits by checking 'Yes' or 'No'. If 'Yes', proceed to complete Part III, otherwise, continue with Part II.

- In Part II, provide information regarding your qualifying persons, including their names and social security numbers. If you have more than two qualifying persons, reference the instructions.

- Add the amounts of qualified expenses from the previous fields. Remember, the maximum is $3,000 for one qualifying person or $6,000 for two or more persons.

- Input your earned income as directed, along with your spouse's earned income if applicable and if married filing jointly.

- Determine the smallest amount from the previous calculations and enter that figure in the relevant field.

- Reference line 7 on Form 1040A for additional calculations related to your credit for child and dependent care expenses.

- Multiply the amounts as needed based on the guidance in the instructions and enter the results on the appropriate lines.

- In Part III, if you indicated receiving dependent care benefits, enter the total amounts received and follow with the necessary calculations regarding benefits carried over or forfeited.

- Finally, review all entries for accuracy before proceeding to save, download, print, or share the completed form.

Complete the necessary forms online for efficient processing and convenience.

Form 1040 Schedule 1 is used to report certain types of income that aren't listed on the main 1040 form. It's also used to claim some tax deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.