Loading

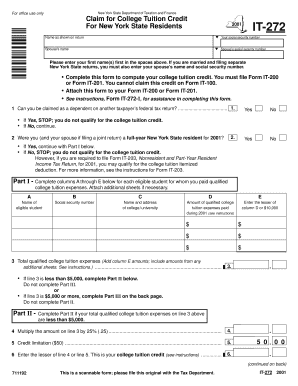

Get New York State Department Of Taxation And Finance For Office Use Only Claim For College Tuition

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance For Office Use Only Claim For College Tuition online

This guide provides clear and comprehensive instructions for filling out the New York State Department Of Taxation And Finance For Office Use Only Claim For College Tuition form online. By following the steps outlined below, users can efficiently complete this essential tax form to claim college tuition credits.

Follow the steps to fill out your Claim for College Tuition online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the designated field as it appears on your tax return along with your social security number. If filing jointly, include your partner's name and their social security number.

- Indicate whether you can be claimed as a dependent on another taxpayer’s federal tax return. If the answer is 'Yes', you are not eligible for the college tuition credit. If 'No', proceed to the next question.

- Confirm if you and your partner (if applicable) were full-year residents of New York State for the relevant year. Respond appropriately and proceed based on your residency status.

- In Part I, provide information for each eligible student for whom you paid qualified college tuition expenses. Complete columns A through E with the student's details, including their social security number, the college attended, and the amount of qualified expenses paid.

- Calculate the total qualified college tuition expenses by adding the amounts in column E from all completed entries.

- If your total expenses are less than $5,000, complete Part II; otherwise, proceed to Part III.

- In Part II, multiply the total expenses by 25% and determine if the credit limitation applies.

- In Part III, if applicable, perform calculations based on your total qualified expenses, following the instructions to finalize your college tuition credit.

- Complete Part IV if you choose to claim the college tuition itemized deduction instead of the credit. Mark the box if applicable.

- Once all sections are completed, review the form for accuracy. Save any changes made to the document, then proceed to download, print, or share the form as required.

Start your online submission for the New York State Claim for College Tuition today!

They include amounts paid for the following items: Tuition and fees. Room and board. Books, supplies, and equipment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.