Loading

Get 1992 Form W-4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1992 Form W-4 online

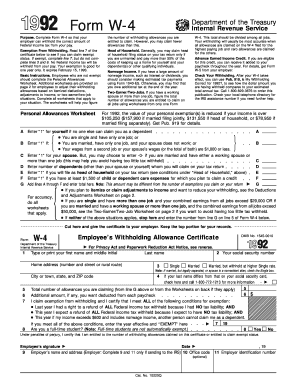

Completing the 1992 Form W-4 online is an essential step for employees to ensure that their federal tax withholding is accurate. This guide provides a clear, step-by-step process to help you fill out the form with confidence.

Follow the steps to complete your Form W-4 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. Provide your first name, middle initial, last name, and home address. Ensure all information is accurate.

- Input your social security number, then select your filing status: 'Single', 'Married', or 'Married, but withhold at higher single rate'. This selection affects your withholding rate.

- Complete the Personal Allowances Worksheet. Enter the number of withholding allowances you are entitled to claim based on your situation, including dependents and filing status.

- If you meet the criteria, check the box for exemption from withholding on line 7 and enter 'EXEMPT' for the year effective. Note that you should not fill out lines 5 and 6 in this case.

- If applicable, complete the Deductions and Adjustments Worksheet if you plan to itemize deductions or make adjustments. Follow the prompts carefully to estimate your itemized deductions and adjustments.

- Once all sections are filled out accurately, review your entries for any errors or omissions. This will help you avoid issues with your tax withholding.

- After reviewing, save your changes to the form. You can then download, print, or share your completed Form W-4 as necessary.

Start filling out your 1992 Form W-4 online today to ensure your tax withholding is accurate.

Share: The W-4 Form is the IRS document you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes and sent to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.