Loading

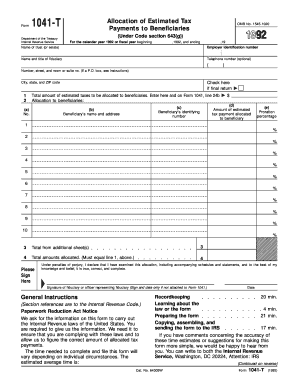

Get 1992 Form 1041t. Allocation Of Estimated Tax Payments To Beneficiaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1992 Form 1041T. Allocation Of Estimated Tax Payments To Beneficiaries online

Filling out the 1992 Form 1041T is essential for fiduciaries who need to allocate estimated tax payments to beneficiaries. This guide provides a clear, step-by-step approach to completing the form accurately and efficiently online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the trust (or estate) and the employer identification number in the designated fields.

- Provide the name and title of the fiduciary, as well as an optional telephone number for contact.

- Fill in the address details, ensuring to include number, street, city, state, and ZIP code. If using a P.O. box, refer to instructions.

- If applicable, check the box to indicate if this is a final return.

- On line 1, enter the total amount of estimated taxes to be allocated to beneficiaries.

- Under 'Allocation to beneficiaries', fill out each column: (a) number sequence, (b) beneficiaries' names and addresses, (c) identification numbers, (d) amount of tax payment allocated, and (e) proration percentage.

- If there are more than 10 beneficiaries, list additional beneficiaries on an attached sheet and enter the total on line 3.

- Ensure that the total amounts allocated on line 4 equal the amount on line 1.

- If filing separately, sign and date the form in the designated signature area.

- Finally, review all entries for accuracy and save changes, download, print, or share the form as needed.

Complete your documents online and ensure accurate tax allocation to beneficiaries.

You are subject to tax on your share of the estate's or trust's income, and you must include your share on your individual tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.