Loading

Get Nv Nucs-4500 1999-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV NUCS-4500 online

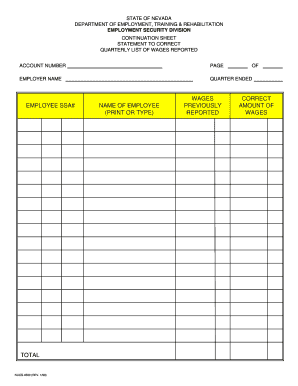

The NV NUCS-4500 form is used to correct quarterly wage reports for employers in Nevada. This guide provides detailed instructions on how to fill out the form online, ensuring a smooth and efficient process.

Follow the steps to complete the NV NUCS-4500 online.

- Click ‘Get Form’ button to obtain the NV NUCS-4500 form and open it in the editor.

- Begin filling out the form by providing your account number at the top of the document. This number helps identify your organization in the system.

- Input the employer name accurately in the designated section. This ensures proper identification of the entity responsible for the wage report correction.

- Specify the quarter ended for which you are reporting corrections. It is crucial to match this with your previous submissions.

- Enter the employee's Social Security Number (SSA#) in the appropriate field to ensure the corrections are linked to the right employee.

- In the 'name of employee' section, clearly print or type the full name of the employee associated with the reported wages.

- Provide the previously reported wages in the designated field to acknowledge what was initially submitted.

- Finally, enter the correct amount of wages in the corresponding field, ensuring it reflects the accurate data.

- Review all the filled sections carefully to confirm accuracy before proceeding to submit.

- After finalizing the entries, you may save the changes, download, print, or share the form as needed.

Complete your NV NUCS-4500 form online today for efficient wage report corrections.

Nevada unemployment tax rates vary based on an employer's experience rating and the current taxable wage base. Employers should stay informed on these rates as they can significantly impact overall payroll costs. Using NV NUCS-4500, you can find accurate and timely information about current tax rates and compliance requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.