Loading

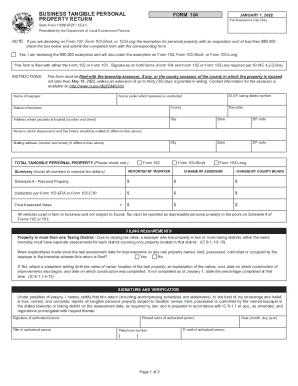

Get In Sf 10068 (form 104) 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN SF 10068 (Form 104) online

Filling out the IN SF 10068 (Form 104) online can be a straightforward process when guided properly. This user-friendly guide will walk you through each section of the form, ensuring you understand what to include and how to submit it efficiently.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the taxpayer as it appears on legal documents. Ensure all information is accurate and reflects current business records.

- Next, input the DLGF taxing district number. This number is crucial as it helps identify the taxing jurisdiction for your property.

- Fill in the name under which the business is conducted. This should match any registered business names.

- Indicate the nature of your business by selecting the most appropriate description from the provided options.

- Enter the county and township where your property is located. This section is vital for correctly routing your form.

- Provide the physical address where the property is situated, including the street number and name, city, state, and ZIP code.

- If the name or address for sending the Assessment and Tax Notice is different, fill that information in accordingly.

- In the total tangible personal property section, check the relevant box to indicate whether you are using Form 102 or Form 103-Short or Long. Report all figures accurately, rounding to the nearest ten dollars.

- Complete Schedule A - Personal Property, ensuring all vehicles used in the business are reported as depreciable property.

- Answer whether there have been improvements made to real property since the last assessment. If yes, be prepared to attach a detailed statement covering required information.

- Sign and verify the form under penalties of perjury at the bottom. Ensure that all required fields are completed before proceeding.

- Once you have filled in all sections of the form accurately, review for any errors or omissions. After confirming all details are correct, save your changes.

- Finally, download, print, or share the completed form as appropriate, and submit it to the relevant assessor's office before the deadline.

Complete your IN SF 10068 (Form 104) online today to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The owner of the property must file State Form 9284 / Form 136 with the County Assessor. The owner must provide all information requested on the application and accompanying information sheet. There is no filing fee. WHAT HAPPENS IF THE OWNERSHIP OR USE OF AN EXEMPT PROPERTY CHANGES?

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.