Loading

Get Lincoln Financial Group Blackout Notice Form 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lincoln Financial Group Blackout Notice Form online

Completing the Lincoln Financial Group Blackout Notice Form is essential for ensuring that affected participants and beneficiaries are properly informed about any blackout periods. This guide provides a clear, step-by-step process to help you fill out the form efficiently and accurately.

Follow the steps to successfully complete the Lincoln Financial Group Blackout Notice Form.

- Press the ‘Get Form’ button to access the Lincoln Financial Group Blackout Notice Form and open it for editing.

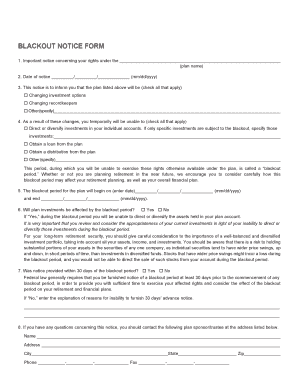

- In the first field, enter the plan name. This identifies the specific plan related to the blackout period.

- Next, specify the date on which the notice will be distributed to affected participants and beneficiaries (in mm/dd/yyyy format).

- Indicate the reason for the blackout period by checking all applicable boxes, such as changing investment options or changing recordkeepers.

- Provide a clear description of the rights under the plan that will be temporarily suspended, limited, or restricted by checking the appropriate boxes.

- Determine and input the start date for the blackout period, which is when the accounts will be temporarily unavailable.

- Insert the end date for the blackout period, which indicates when affected participants can resume directing or diversifying their investments.

- Check ‘Yes’ or ‘No’ to indicate if the plan investments will be affected by the blackout period. If 'Yes,' remind users they cannot direct or diversify assets during this time.

- Answer whether the notice was provided within the required 30-day advance notice period by checking ‘Yes’ or ‘No.’ If 'No,' explain why.

- Provide contact information for the plan administrator or trustee in case users have questions regarding the notice.

Complete your Lincoln Financial Group Blackout Notice Form online to ensure compliance and timely communication.

A 401(k) blackout period is a hiatus during which plan participants may not make certain changes to their 401(k) accounts. Employers who offer 401(k) plans typically impose blackouts when they need to update or alter aspects of their plans. A blackout period may last anywhere from a few days to several weeks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.