Loading

Get Usda Ccc-926 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA CCC-926 online

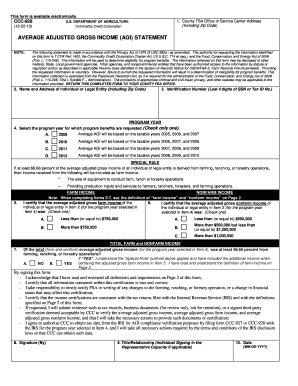

The USDA CCC-926 form, also known as the Average Adjusted Gross Income Statement, is a crucial document for individuals and legal entities seeking benefits under various commodity and conservation programs. This guide provides clear instructions on how to accurately complete the form online, ensuring eligibility for program benefits.

Follow the steps to complete the USDA CCC-926 online.

- Click the ‘Get Form’ button to access the USDA CCC-926 form online. This action will direct you to the editable version of the form.

- Begin by entering the county FSA office or service center address in the designated field, including the zip code. This information helps in identifying the relevant processing office for your application.

- Provide the name and address of the individual or legal entity. Ensure that you include the full address along with the zip code.

- Input the identification number, which can be the last four digits of your Social Security Number or your Tax Identification Number. This helps to uniquely identify your application.

- Select the program year for which you are applying for benefits. Check only one box from the options provided, from 2009 to 2012, as this determines the applicable tax years for calculating your average AGI.

- Certify the average adjusted gross farm income based on your selection in the previous step. Select one of the options ranging from less than or equal to $750,000 to more than $1,000,000, depending on your reported income.

- Next, certify the average adjusted gross nonfarm income for the same program year. Similarly, choose the appropriate income level from the provided options.

- Indicate whether at least 66.66 percent of your total average adjusted gross income comes from farming, ranching, or forestry operations. This is an important detail that affects your eligibility based on the special rule.

- Proceed by signing the form, where you acknowledge the accuracy of the information provided and agree to comply with all stated requirements.

- Enter your title or relationship if you are signing on behalf of an individual or legal entity. This helps clarify your capacity in signing the document.

- Finally, input the date of signing in the specified format (MM-DD-YYYY) to finalize your application.

- Once you have completed all sections, you can save your changes, download the form for your records, print it for submission, or share it as necessary.

Complete your USDA CCC-926 form online today to ensure you receive your eligible program benefits.

Related links form

Contributing to an FSA reduces taxable wages since the account is funded with pretax dollars. Since your FSA contribution is paid in pretax dollars, it cannot be taken as a tax deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.