Get Option 4 Is For Both A Tax Transcript And A Tax Account Transcript ... - Wcupa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OPTION 4 Is For Both A Tax Transcript And A Tax Account Transcript ... - Wcupa online

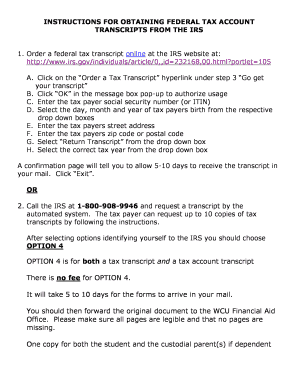

This guide provides detailed instructions on how to fill out the OPTION 4 form for obtaining both a tax transcript and a tax account transcript. Following these steps will ensure you can successfully complete the process online.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to access the document and open it for editing.

- Read the instructions carefully to understand the requirements for filling out the form.

- If completing online, access the IRS website and locate the ‘Order a Tax Transcript’ option under step 3. This is essential for obtaining the necessary transcripts.

- After clicking the hyperlink, authorize the usage by clicking ‘OK’ when prompted in the pop-up message box.

- Enter the taxpayer’s social security number (or ITIN) in the designated field.

- From the dropdown lists, select the day, month, and year of the taxpayer’s birth.

- Provide the taxpayer’s street address in the appropriate section.

- Fill in the taxpayer’s zip code or postal code accurately.

- Choose ‘Return Transcript’ from the dropdown options to specify the type of transcript required.

- Select the correct tax year from the dropdown list to ensure you request the appropriate documents.

- Review your entries for accuracy and completeness to avoid any processing delays.

- Submit your request and wait for the confirmation page indicating you should allow 5-10 days for the transcripts to arrive by mail.

- Once received, ensure that all pages are legible and intact before forwarding the original documents to the WCU Financial Aid Office.

- Make sure to keep one copy of the documents for both the student and the custodial parent(s) if applicable.

Complete your forms online today to ensure timely processing of your tax transcripts.

You should find this amount on your pay stub. If it's not on your pay stub, use gross income before taxes. Then subtract any money the employer takes out for health coverage, child care, or retirement savings. Multiply federal taxable wages by the number of paychecks you expect in the tax year to estimate your income. How to estimate your expected income and count household ... healthcare.gov https://.healthcare.gov › income-and-household-inf... healthcare.gov https://.healthcare.gov › income-and-household-inf...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.