Loading

Get Credit Line Account And Personal Loan Application - Focuscu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

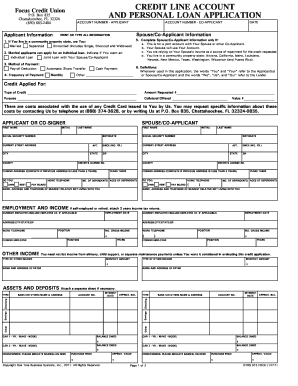

How to fill out the CREDIT LINE ACCOUNT AND PERSONAL LOAN APPLICATION - Focuscu online

Filling out the Credit Line Account and Personal Loan Application is a key step in securing the financial assistance you need. This guide provides a clear and supportive approach to navigating each section of the application form online, ensuring that you have the information you need to succeed.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to access the application form and open it for editing.

- Begin by entering your applicant information, including the account number, your name, and contact details. Make sure to fill in all fields accurately.

- If applicable, complete the co-applicant information section with similar details for the individual joining you on the application.

- Indicate your current living situation by checking the appropriate box if you live in a community property state. Specify your marital status by selecting married, separated, or unmarried.

- Decide whether you are applying for an individual loan or a joint loan with your spouse or co-applicant. Mark your choice accordingly.

- Select your preferred method of payment. Options may include payroll deduction or other arrangements.

- Fill in payment frequency specifics, choosing how often payments will be made.

- Detail the credit being applied for, including the type of credit, the amount requested, and the purpose of the loan. Be as specific as possible.

- Complete the applicant and co-signer sections with personal details like social security number, birthdate, current address, and contact information.

- Provide information about your employment and income, including details about current and former employers, position, and monthly gross income.

- List all assets and deposits, including balances and types of accounts, and any vehicles owned. Attach a separate sheet if additionally needed.

- Complete credit obligations by listing all open accounts and obligations. Answer any required questions about past financial activities.

- Consider optional credit insurance and indicate your interest level by checking respective boxes.

- Finally, ensure you provide your signature along with the date while also confirming understanding of the information you provided.

- After filling out the form, save your changes, and choose to download, print, or share the completed document as needed.

Take the next step towards your financial goals by completing your application online today.

To land one, you'll need to present a credit score in the upper-good range — 700 or more — accompanied by a history of being punctual about paying debts. Similar to a personal loan or a credit card, an unsecured personal line of credit gets bank approval based on an applicant's ability to repay the debt.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.