Loading

Get Reset Form Attachment 20 Michigan Department Of Treasury 4594 (rev - Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reset Form Attachment 20 Michigan Department Of Treasury 4594 (Rev - Michigan online

This guide provides clear and detailed instructions on how to properly fill out the Reset Form Attachment 20 Michigan Department Of Treasury 4594 (Rev) online. Whether you are a seasoned filer or new to the process, these steps are designed to assist you in completing the form accurately.

Follow the steps to complete the Reset Form Attachment 20.

- Press the ‘Get Form’ button to access the Reset Form Attachment 20. Ensure you have the form open in your editing platform before proceeding.

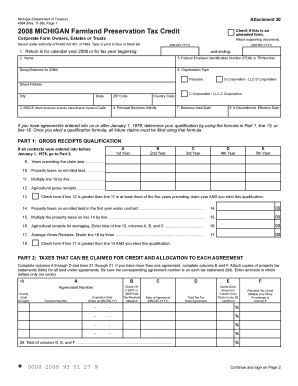

- In section 1, specify the return year by entering either '2008' or the tax year beginning and ending dates. Make sure the date format is MM-DD-YYYY.

- Complete section 2 by providing the full name of the entity or individual filing the form, along with the Federal Employer Identification Number (FEIN), Doing Business As (DBA) name, organization type, and address details including street, city, state, and ZIP code.

- Fill out the NAICS (North American Industry Classification System) code in section 3. If unsure, consult the U.S. Census Bureau website for the correct code.

- Indicate the principal business activity in section 4 by describing the primary operations of your business.

- In section 7, provide the date the business started, and if applicable, the effective date of any discontinuation in section 8.

- Proceed to Part 1 for gross receipts qualification. Enter the appropriate information for the first five years and check the relevant boxes that apply based on your agricultural gross receipts.

- Complete Part 2 by entering details for each farmland preservation agreement, including agreement numbers, amount of taxes, and confirming if tax receipts are attached.

- Finish by carefully reviewing Parts 3, 4, and the certification section, ensuring all calculations are accurate and signatures are provided as required.

- Save your changes, and then download, print, or share the form as needed for submission.

Complete your forms online efficiently and accurately by following this guide.

This letter was sent because the Discovery and Tax Enforcement Division has selected your return for review and additional information is required to process your return. A list of the required information can be found in the body of the letter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.