Loading

Get Rp-485-j (amsterdam) (fill-in) - Department Of Taxation And Finance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RP-485-j (Amsterdam) (Fill-in) - Department Of Taxation And Finance online

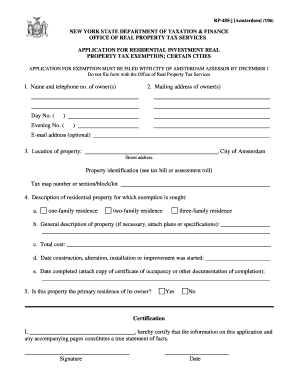

Filling out the RP-485-j form is essential for applying for a residential investment real property tax exemption in the City of Amsterdam. This guide will provide you with step-by-step instructions to ensure that you complete the form correctly and efficiently.

Follow the steps to complete the RP-485-j form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name and telephone number of the owner(s) in the designated fields. Ensure that this information is accurate as it will be used for all communication regarding the application.

- Provide the mailing address of the owner(s). This should be the current address where correspondence can be sent.

- Enter the location of the property. Include the street address and property identification details such as tax map number or section/block/lot.

- Describe the residential property for which exemption is being sought. Indicate if it is a one-family, two-family, or three-family residence and provide a general description if necessary.

- Document the total cost of construction, alteration, installation, or improvement. Be sure to include the relevant commencement and completion dates, along with attaching a copy of the certificate of occupancy or other evidence of completion if applicable.

- Specify if this property is the primary residence of the owner by selecting 'Yes' or 'No'.

- In the certification section, the owner must provide their name, signature, and the date to certify that all provided information is accurate and truthful.

- After completing all fields, review the form for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your RP-485-j form online today to secure your residential investment property tax exemption.

DHE lowers the property taxes of eligible New Yorkers with disabilities. You may be able to reduce your home's assessed value by 5-50% depending on your income. Apply by March 15th for benefits to begin on July 1st of that year. If March 15th falls on a weekend or holiday, the deadline is the next business day.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.