Loading

Get Rp-421-j Niagara Falls - Department Of Taxation And Finance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RP-421-j Niagara Falls - Department Of Taxation And Finance online

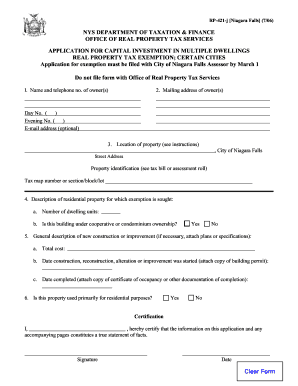

This guide provides step-by-step instructions on completing the RP-421-j form for a real property tax exemption in Niagara Falls. Users will be able to fill out the application online, ensuring they have all necessary information to submit it correctly.

Follow the steps to fill out the RP-421-j form accurately.

- Press the ‘Get Form’ button to access the RP-421-j document online and open it in your preferred editor.

- In section 1, provide the name and telephone number of the owner or owners. Ensure the information is accurate for contact purposes.

- In section 2, input the mailing address for the owner or owners, including both day and evening contact numbers, and an optional email address.

- For section 3, input the location of the property in Niagara Falls, including the street address and the property identification number found on the tax bill or assessment roll.

- In section 4, describe the residential property. Specify the number of dwelling units and indicate whether the building is under cooperative or condominium ownership.

- In section 5, detail any new construction or improvements. Include total costs, the date construction started (attach a copy of the building permit), and the completion date (attach documentation such as a certificate of occupancy).

- In section 6, answer whether the property is used primarily for residential purposes with a simple 'yes' or 'no'.

- Complete the certification section with your name, signature, and date, confirming that the information provided is true.

- After reviewing all the entered information, you can choose to save the changes, download, print, or share the completed form as required.

Complete your RP-421-j form online today to ensure timely submission and eligibility for your tax exemption.

New York Property Tax Rates CountyMedian Home ValueAverage Effective Property Tax RateNew York$1,024,5000.98%Niagara$131,6002.89%Oneida$133,1002.59%Onondaga$148,1003.01%58 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.