Loading

Get 2005 Instructions For Form 2106

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Instructions For Form 2106 online

Filling out the 2005 Instructions for Form 2106 can be a straightforward process with the right guidance. This guide provides detailed steps to help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

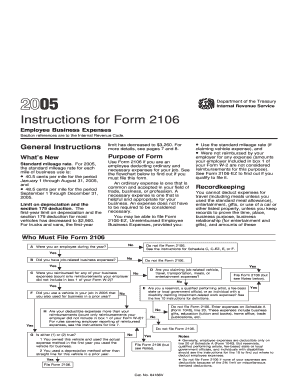

- Begin by reviewing the general instructions provided on the form. These will give you an overview of what types of expenses can be deducted and the eligibility criteria for filing Form 2106.

- Complete Part I if you had job-related business expenses. If reimbursed, fill in the applicable lines for your expenses and reimbursements, ensuring you detail amounts accurately.

- In Part II, if applicable, select the method for computing your vehicle expenses. Choose between the standard mileage rate or actual expenses and fill in the necessary details based on your choice.

- Enter all relevant totals based on the instructions for lines that pertain to meals, travel, or other business-related costs.

- After completing all sections, review your entries for accuracy. Ensure that any deductions comply with current IRS guidelines outlined in the instructions.

- Finally, save your changes to the form. You may then download, print, or share as needed according to your filing requirements.

Start completing your documents online to streamline your filing process.

However, with tax reform, all miscellaneous “2%” expenses, including unreimbursed employee expenses are not allowed between 2018 and 2025. Expenses such as union dues, work-related business travel, or professional organization dues are no longer deductible, even if the employee can itemize deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.