Loading

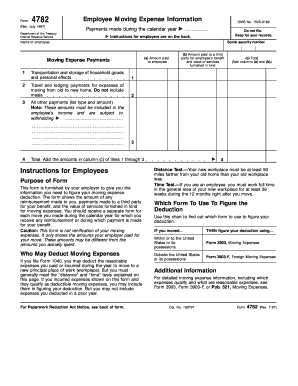

Get Form 4782 (rev. July 1997), (not Fill-in Capable). Employee Moving Expense Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4782 (Rev. July 1997), (NOT Fill-In Capable). Employee Moving Expense Information online

Filling out the Form 4782 is essential for documenting employee moving expenses. This guide provides step-by-step instructions to help users complete the form accurately, ensuring compliance with relevant tax regulations.

Follow the steps to fill out the Form 4782 effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter the name of the employee who experienced the move.

- Next, input the employee's social security number in the designated field.

- For the 'Amount paid to employee' section, list the actual reimbursement amounts for the following categories: transportation and storage of household goods, and travel and lodging expenses (excluding meals). Record each amount in the corresponding lines.

- In the section labeled 'Amount paid to a third party for employee’s benefit,' indicate the payments made directly to service providers on behalf of the employee.

- Calculate the total amount for each category by adding both amounts from the previous columns to verify the total moving expenses.

- For any additional payments, such as those that do not fit into previous categories, specify the type and amount in the provided space.

- Finally, sum the total moving expense amounts to provide a comprehensive overview of expenses. Ensure all calculations are accurate before proceeding.

- Once completed, save the form for your records. You may also choose to download, print, or share the completed form as needed.

Complete your documents online with confidence and ensure all forms are filled out accurately.

While moving is expensive, there are a few ways that you may be able to get the money you need. Save and pay cash. Saving money for an unexpected move can be difficult. ... Personal loans. ... Credit cards. ... Relocation assistance. ... Instate vs. ... Moving costs based on house size.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.