Loading

Get Part 6 Application Of Credit And Computation Of Carryover (see Instr - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Part 6 Application Of Credit And Computation Of Carryover (see Instr - Tax Ny online

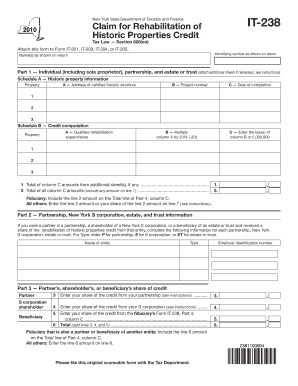

The Part 6 Application of Credit and Computation of Carryover is an essential section for claiming rehabilitative credits on your tax return. This guide will help you navigate through the form efficiently, providing clarity on each section and how to accurately fill it out.

Follow the steps to successfully complete the application.

- Press the ‘Get Form’ button to acquire the application form and view it in your digital environment.

- In Part 6, start by entering the total credit from line 12. This is the total rehabilitation of historic properties credit you are claiming.

- Next, input the New York recapture amount from line 26 if applicable. This amount represents any recapture of credit you may owe.

- Fill in the total rehabilitation of historic properties credit as specified in the instructions provided. This figure is fundamental to your tax calculations.

- Then, document the net recapture of rehabilitation of historic properties credit according to the guidelines. This ensures your calculations reflect any adjustments correctly.

- Enter the tax due before applying any credits as indicated in the instructions. This amount is derived from your overall taxable income.

- Record the credits applied against the tax before this credit. Make sure to review previous lines carefully for accuracy.

- Calculate the net tax by subtracting the amount from line 18 (credits applied) from line 17 (tax due). It's crucial to get this number right.

- Input the amount applied against this year's tax, selecting the lesser amount from line 15 or line 19, based on your calculations.

- Finally, subtract line 20 (the amount applied against this year's tax) from line 13 (total credit) to determine the amount of credit available for carryover to next year.

Complete your document online today to ensure a smooth filing process.

To choose the deduction, you must deduct foreign income taxes on Schedule A (Form 1040), Itemized Deductions. To choose the foreign tax credit, you generally must complete Form 1116 and attach it to your Form 1040, Form 1040-SR or Form 1040-NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.