Loading

Get Taxpayer Identification Number(s) Shown On Return - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

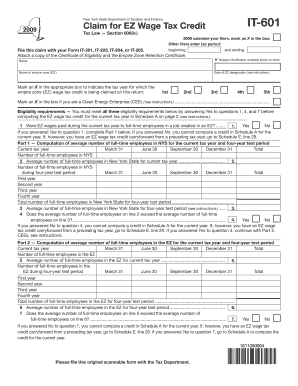

How to fill out the Taxpayer Identification Number(s) shown on return - Tax Ny online

This guide provides essential instructions for accurately completing the Taxpayer Identification Number(s) shown on return - Tax Ny form online. Whether you are a first-time filer or familiar with the process, these step-by-step directions are designed to assist you in fulfilling your tax obligations seamlessly.

Follow the steps to complete your taxpayer identification number(s) form online.

- Click ‘Get Form’ button to access the form for completion in an editable format.

- Enter your name in the designated section at the top of the form. This is crucial as it identifies you as the filer.

- Indicate the date of EZ designation in the specified field. This date tells the tax authority when you were recognized as part of the Empire Zone.

- Specify the name of the Empire Zone (EZ) where relevant tax credits apply. This section helps determine eligibility for various credits.

- Mark an X in the appropriate box to identify the tax year for which you are claiming the EZ wage tax credit, ensuring you select the right period.

- Fill in the taxpayer identification number(s). You can list up to five on the form. Each number should be entered clearly to avoid processing delays.

- If applicable, indicate if you are a Clean Energy Enterprise by marking the corresponding box.

- Proceed to answer the eligibility questions, ensuring you respond accurately. This includes confirming if EZ wages were paid to full-time employees in an EZ.

- Complete the sections for computations related to full-time employees working in New York, including the average number over current and preceding years.

- After completing all required fields, take a moment to review your entries for any errors or omissions.

- Once satisfied with the information entered, save your changes, and download or print the completed form for submission.

Start completing your taxpayer identification number(s) form online today.

A California EIN number is a California State ID number. You will need this eight-digit number if your business sells taxable goods and services in the state of California, or if your business will owe excise taxes (applicable to specific products such as alcohol or tobacco).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.