Loading

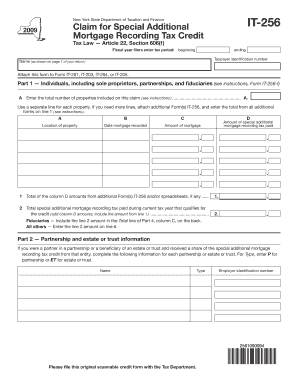

Get Part 6 Application Of Credit And Computation Of Carryover ( See The Instructions To - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Part 6 Application Of Credit And Computation Of Carryover (See The Instructions To - Tax Ny online

Filling out the Part 6 Application Of Credit And Computation Of Carryover is an essential task for those seeking to claim tax credits effectively. This guide provides clear, step-by-step instructions to assist users in accurately completing this form.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to retrieve the form and open it in your preferred editing tool.

- Begin by entering the total credit amount from Part 5, line 11 into line 12 of Part 6.

- Next, provide the amount that you applied against your 2009 tax on line 13, as instructed.

- To calculate the amount of credit available for carryover to 2010, subtract the amount on line 13 from the total credit on line 12 and enter the result on line 14.

- Review all your entries for accuracy before proceeding to save your changes.

- Finally, ensure to download, print, or share the completed form as necessary for your records or submission.

Complete your documents online to ensure a smooth filing process.

Line 19 is a manual entry of the Child Tax Credit and Credit for Other Dependents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.