Loading

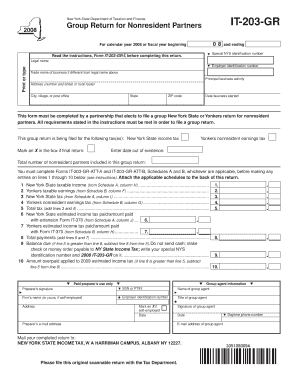

Get It-203-gr New York State Department Of Taxation And Finance Group Return For Nonresident Partners 0

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-203-GR New York State Department Of Taxation And Finance Group Return For Nonresident Partners 0 online

Filling out the IT-203-GR form is essential for partnerships seeking to file a group return for nonresident partners in New York State. This guide provides clear, step-by-step instructions to help you navigate the online filling process efficiently.

Follow the steps to complete your IT-203-GR form online.

- Click ‘Get Form’ button to access the IT-203-GR and open it in the editor.

- Enter the special New York State identification number, which is required to process your return. Ensure to print or type this information clearly.

- Provide the legal name of the partnership along with the employer identification number. If the trade name is different, include it in this section.

- Fill in the principal business activity of the partnership, followed by the complete address including the city, state, and ZIP code.

- Indicate the date the business started to ensure accurate tax processing. This information is crucial for the tax department.

- Confirm whether this is the final return. If applicable, mark an X in the designated box.

- Input the total number of nonresident partners included in this group return. This figure affects the overall assessment of your tax return.

- Before proceeding to lines 1 through 10, make sure to complete Forms IT-203-GR-ATT-A and IT-203-GR-ATT-B, attaching any required schedules to the back of the return.

- Enter each applicable income and tax information from your completed schedules into the respective lines 1-10, including New York State taxable income, Yonkers taxable earnings, and total taxes.

- Review your entries for accuracy, then finalize by opting to save, download, print, or share the completed form as needed.

Complete your IT-203-GR form online today to ensure a smooth filing process.

You are a nonresident with New York source income and your New York adjusted gross income Federal amount column (Form IT-203, line 31) exceeds your New York standard deduction. You want to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from your pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.