Loading

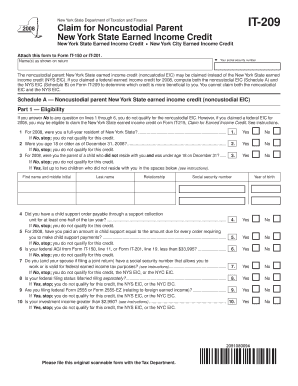

Get Form It-209:2008:claim For Noncustodial Parent - The New York ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-209:2008: Claim For Noncustodial Parent - The New York State Earned Income Credit online

Filling out the Form IT-209 is essential for noncustodial parents in New York seeking to claim the New York State Earned Income Credit. This guide provides clear, step-by-step instructions to help users accurately complete the form online.

Follow the steps to successfully complete your claim.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your social security number and the name(s) as shown on your tax return in the designated fields.

- In Schedule A, Part 1 — Eligibility, answer the questions from lines 1 to 10, ensuring that you qualify for the noncustodial earned income credit. If you answer 'No' to any question, you may not be eligible for this credit.

- In Part 2 — Claiming the credit, indicate if you have already filed your 2008 New York State income tax return. If so, note that you must file an amended return to claim the credit.

- In Part 3 — Earned Income, provide details about your income. Enter wages, business income, and any other relevant earnings in the specified lines for total income computation.

- Proceed to Part 4 — Credit Computation, where you will calculate your noncustodial earned income credit based on your total earned income and federal adjusted gross income.

- Complete Schedule B for New York State earned income credit, ensuring to provide necessary details, including whether you claimed federal EIC.

- If applicable, fill out Schedule C for New York City earned income credit by answering the residency questions and entering relevant income figures.

- Review all entries for accuracy and completeness before finalizing your form.

- Once satisfied with your entries, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Form IT-209 online to ensure you claim your eligible credits promptly.

YCTC may provide you with cash back or reduce any tax you owe. California families qualify with earned income of $30,931 or less. You also must have a qualifying child under 6 years old at the end of the tax year and qualify for CalEITC – with one exception.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.