Loading

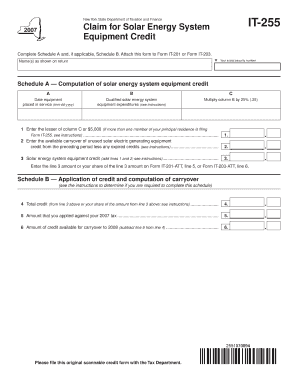

Get Attach This Form To Form It-201 Or Form It-203

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Attach This Form To Form IT-201 Or Form IT-203 online

This guide provides a comprehensive overview of how to competently fill out the Attach This Form To Form IT-201 Or Form IT-203 online. Follow these clear instructions to ensure your application meets all requirements.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- Begin filling out the sections as indicated on the form. Start with entering your name(s) as shown on your return and your Social Security number in the designated fields.

- Proceed to Schedule A, where you will compute the solar energy system equipment credit. In column B, input the qualified solar energy system equipment expenditures. If you are a tenant-shareholder or condominium owner, enter your share of the expenses.

- In column C, calculate 25% of the qualified expenditures listed in column B.

- For line 1, enter the lesser of the amount calculated in column C or $5,000. If applicable, refer to the instructions for specific cases regarding multiple taxpayers.

- For line 2, include any available carryover of unused solar credit from the previous period, ensuring you account for any expired credits.

- On line 3, add the amounts from lines 1 and 2 to compute your total solar energy system equipment credit.

- Transition to Schedule B if required, and apply your credit computations and carryover as instructed.

- Once all necessary fields are completed and validated, you can save changes, download, print, or share the form as needed.

Complete your tax forms online today for a smooth filing experience.

You must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, if you: were not a resident of New York State and received income during the tax year from New York State sources, or. moved into or out of New York State during the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.