Loading

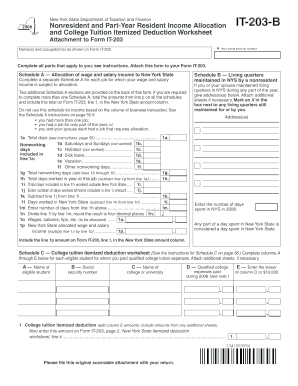

Get Expenses Paid Of Column D Or $10000 During 2006 (see Instr - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Expenses Paid Of Column D Or $10000 During 2006 (see Instr - Tax Ny online

This guide provides clear and actionable steps for filling out the Expenses Paid Of Column D Or $10000 During 2006 form. With straightforward instructions, you can efficiently complete your tax requirements online.

Follow the steps to accurately complete the tax form.

- Press the ‘Get Form’ button to access and open the form in your preferred document editor.

- Begin with your social security number at the top of the form. Ensure that the name(s) and occupation(s) are as shown on Form IT-203. Complete all applicable sections as per the instructions provided.

- Move to Schedule A, where you will allocate wage and salary income to New York State. Complete a separate Schedule A for each job, totaling amounts from line p on all schedules.

- Continue by filling in the total days worked at each job and the breakdown of nonworking days, including sick leaves and vacations, as required by the instructions.

- For Section C, which focuses on the college tuition itemized deduction, enter the name, social security number, and college of each eligible student for whom you paid qualified college expenses.

- Fill in Column D with the qualified college expenses paid during 2006. Record the appropriate amounts in Column E, ensuring it reflects the lesser of the total in Column D or $10,000.

- Review all information thoroughly to ensure accuracy before finalizing your form. You can then save changes, download, print, or share the completed form as needed.

Complete your tax documents online today to ensure timely and accurate filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.