Loading

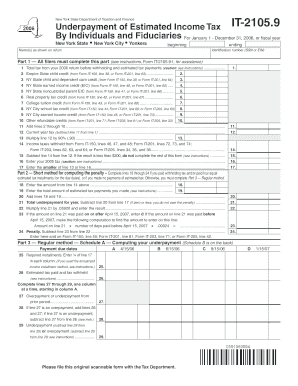

Get By Individuals And Fiduciaries For January 1 - December 31, 2006, Or Fiscal Year - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the By Individuals And Fiduciaries For January 1 - December 31, 2006, Or Fiscal Year - Tax Ny online

Filling out the By Individuals And Fiduciaries For January 1 - December 31, 2006, Or Fiscal Year - Tax Ny can be a straightforward process if you follow the right steps. This guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete your tax form online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin filling out the identification section, ensuring you correctly input the name(s) as shown on your return and your identification number (SSN or EIN).

- Complete Part 1, which all filers must fill out. Start with line 1 where you should enter the total tax from your 2006 return before any withholding and estimated tax payments.

- Continue with lines 2 through 10, entering any applicable credits from the specified forms (Form IT-150 or Form IT-201) based on your situation.

- Calculate the current year tax by subtracting the total credits (line 11) from the total tax (line 1), and enter the result on line 12.

- On line 13, multiply the result from line 12 by 90% to determine if you've paid enough estimated taxes.

- Input any taxes withheld on line 14, and then subtract this value from line 12 for line 15. If the result is less than $300, you can skip the remaining form.

- Proceed to Part 2 for the penalty calculation if applicable. Use lines 18 through 24 to compute the penalty according to your estimated tax payments.

- For users needing the regular method, navigate to Part 3, filling out Schedule A first by entering required installment amounts in the appropriate columns.

- Complete Schedule B to compute any penalties related to underpayment, ensuring to add and multiply according to the provided formulas.

- Once all relevant sections are filled out, review your entries for accuracy. Finally, save your completed form, and consider downloading, printing, or sharing it as needed.

Start filling out your form online to ensure compliance and manage your tax responsibilities effectively.

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.