Loading

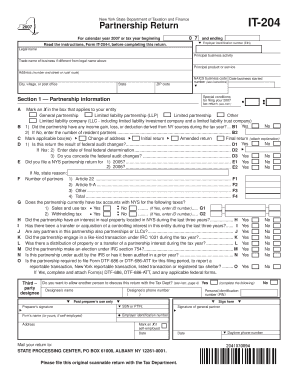

Get New York State Department Of Taxation And Finance It-204 Partnership Return 0 7 For Calendar Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department of Taxation and Finance IT-204 Partnership Return 07 for Calendar Year online

The New York State Department of Taxation and Finance IT-204 Partnership Return is a crucial document for partnerships operating in New York. This guide provides step-by-step instructions to help users navigate the online form effectively and accurately.

Follow the steps to fill out the IT-204 Partnership Return form with ease.

- Click ‘Get Form’ button to access the partnership return form and open it for completion.

- Begin by entering the employer identification number (EIN) and the legal name of the partnership in the designated fields.

- Fill out the address section with the correct number and street, city, state, and ZIP code.

- In Section 1, select the appropriate box that categorizes your partnership type, such as limited partnership, general partnership, or limited liability company.

- Proceed to Section 2 and report the federal ordinary business income or loss.

- Complete Section 3 by providing information related to the cost of goods sold, including inventory figures.

- Continue to fill out Section 4, which requires balance sheet data per books.

- Move to Section 5 to reconcile income per your books with the reported income on the return.

- In Section 6, analyze partners' capital accounts and list all necessary figures pertaining to capital contributed, income, and distributions.

- Complete the final sections, including partners' share of income, New York modifications, and any other required additional information.

Take charge of your partnership's tax reporting by filling out the IT-204 form online today.

The Form IT-204-IP provided to you by your partnership lists your distributive share of any credits, credit components, credit factors, recapture of credits, and any other information reported by the partnership during the tax year. You need this information when completing your individual income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.