Loading

Get Oh Form R-i - City Of Dayton 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH Form R-I - City Of Dayton online

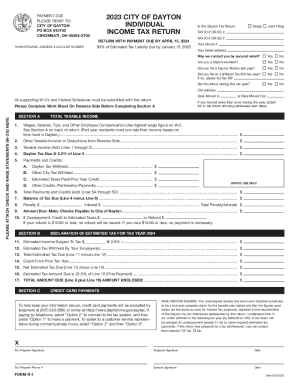

Filling out the OH Form R-I for individual income tax in Dayton is a straightforward process when done online. This guide will walk you through each section and field, ensuring you provide all necessary information accurately.

Follow the steps to complete the OH Form R-I online.

- Click the ‘Get Form’ button to obtain the form and access it in the editor.

- Enter your taxpayer name, address, and account number. Ensure that your information is accurate and up-to-date.

- Indicate your filing status by selecting either 'Single' or 'Joint Filing'.

- Provide your Tax ID or Social Security Number and the Tax ID or SS Number of your partner, if applicable.

- Fill in your phone number and email address. Indicate whether you would like to be contacted via secured email.

- Specify if you are a Dayton resident by selecting 'Yes' or 'No'.

- Answer whether you filed a Dayton return last year, and if you did on a different Tax ID, provide that information.

- Indicate if you moved during the tax year, providing your old address and the date you moved if applicable.

- Complete Section A, calculating your total taxable income based on your wages, salaries, and other compensation. Include any other taxable income and sum it up.

- List all payments and credits in the respective sections, ensuring to follow the line instructions for accuracy.

- Review the balance of tax due and any potential refund. Make sure to verify all calculated amounts.

- If applicable, complete Section B for the declaration of estimated tax for the upcoming year, following the provided instructions.

- Before signing, read the declaration carefully. Ensure all attached schedules and necessary documents are included.

- Finally, save your changes, download, print, or share the completed form as required.

Complete your OH Form R-I easily and accurately by using this online guide.

Related links form

The minimum combined 2023 sales tax rate for Dayton, Ohio is 7.5%. This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The County sales tax rate is 1.75%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.