Loading

Get St-9 Sales And Use Tax Return - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

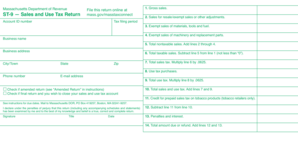

How to fill out the ST-9 Sales And Use Tax Return - Mass online

Completing the ST-9 Sales And Use Tax Return online is an essential task for businesses in Massachusetts. This guide provides step-by-step instructions to help you accurately fill out the form, ensuring compliance with tax regulations.

Follow the steps to successfully complete your ST-9 form.

- Press the ‘Get Form’ button to obtain the ST-9 Sales And Use Tax Return form and open it in the editor.

- Enter your account ID number at the top of the form. This number is essential for identifying your business.

- Report your gross sales in the designated field as this will be the base for your tax calculations.

- Calculate total taxable sales by subtracting total nontaxable sales (line 5) from gross sales (line 1). Ensure this amount is not less than zero.

- Report any use tax purchases in line 8, where applicable.

- Check the box for an amended return if applicable. Additionally, check if this is your final return if you wish to close your sales and use tax account.

- Add the totals from line 7 and line 9 to calculate total sales and use tax, entering this amount in line 10.

- Subtract line 11 from line 10 to determine the net amount due. Enter this in line 12.

- Calculate the total amount due or refund by adding lines 12 and 13, and input this figure in line 14.

- Finally, review all entered information, sign the form, and include your title and date before submitting.

- Once you have completed the form, you may save changes, download a copy for your records, print, or share the form as needed.

Complete your ST-9 Sales And Use Tax Return online today to ensure compliance and avoid penalties.

You have several options for filing and paying your Massachusetts sales tax: File online – File online at the Massachusetts Department of Revenue. You can remit your payment through their online system. ... File by mail – Fill out and mail in form ST-9. AutoFile – Let TaxJar file your sales tax for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.