Loading

Get La R-19026 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-19026 online

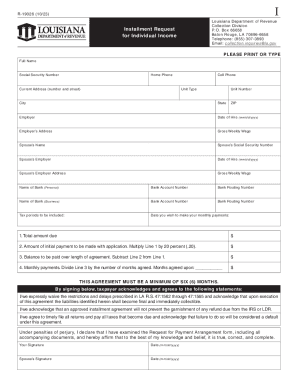

The LA R-19026 form is an installment request for individual income taxes provided by the Louisiana Department of Revenue. This guide will help you navigate the process of filling out this form online, ensuring you meet all necessary requirements for your installment agreement.

Follow the steps to complete your installment request form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name as it appears on your tax records in the designated field.

- Provide your Social Security number in the corresponding field, ensuring accuracy to avoid delays.

- Fill out your home phone number and current address, including city, state, and ZIP code.

- If applicable, enter your cell phone number for further communication regarding your application.

- Complete the employment section by entering your employer's name and address along with your date of hire and gross weekly wage.

- If you have a spouse, include their name, Social Security number, employment details, and gross weekly wage.

- Input the name of your personal bank, including all necessary bank account and routing numbers.

- List the tax periods you wish to include in your installment agreement, ensuring it meets the minimum requirements.

- Calculate the total amount due and fill in the amount of the initial payment, which should be 20% of the total amount.

- Determine the remaining balance to be paid and divide it by the number of months you plan to complete the payments.

- Sign and date the agreement, ensuring all information is accurate and verifying your understanding of the agreement terms.

- After completing the form, save your changes and choose to download, print, or share the completed document as needed.

Complete your LA R-19026 request online to ensure timely processing of your installment agreement.

Related links form

Louisiana State Offer in Compromise: How to Pay Less. The Louisiana Department of Revenue (LDR) has the ability to settle state tax liabilities up to $500,000 for less than you owe. The LDR will only settle tax bills when there is serious doubt of liability or doubt of collectibility.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.