Loading

Get Nm Pit-b 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM PIT-B online

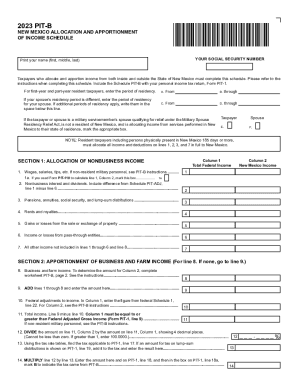

Filling out the New Mexico Allocation and Apportionment of Income Schedule, known as the NM PIT-B, is an important step for taxpayers who allocate and apportion income from both inside and outside New Mexico. This guide provides detailed instructions to ensure you successfully complete the form online.

Follow the steps to complete the NM PIT-B online.

- Click ‘Get Form’ button to obtain the NM PIT-B and access it for completion.

- Begin by entering your social security number in the designated field at the top of the form. Be sure to print your name, including your first, middle, and last names, in the specified area.

- If applicable, indicate the period of residency for yourself and your spouse. Use the fields labeled 'From' and 'through' to provide the relevant dates.

- If your residency or your spouse's residency differs or if additional periods apply, document these as necessary in the provided space.

- If you or your spouse qualifies for relief under the Military Spouse Residency Relief Act, indicate this by marking the appropriate box.

- Proceed to Section 1 for the allocation of nonbusiness income. Fill in lines 1 through 7 to report various forms of income, including wages, interest, dividends, and other specified income types. Make sure to differentiate between New Mexico income and total federal income.

- Continue to Section 2 to apportion any business and farm income. If you have business or farm income, use the worksheet provided to calculate the relevant figures and complete line 8.

- Sum lines 1 through 8 and enter the total on line 9. Make any necessary federal adjustments to income as indicated on line 10.

- Calculate total income by subtracting line 10 from line 9 and record this figure on line 11.

- Complete the tax calculation on lines 12 through 14 using the applicable tax rate tables and ensuring you follow the instructions carefully.

- If you are reporting business or farm income, complete the necessary worksheets for apportionment, detailing property, payroll, and sales factors as required.

- After filling out all relevant sections and reviewing your entries for accuracy, save the changes made to your completed NM PIT-B, and prepare to download, print, or share it as needed.

Begin filling out your NM PIT-B online today to ensure proper allocation and apportionment of your income.

Related links form

Federal income taxes are collected by the federal government, while state income taxes are collected by the individual state(s) where a taxpayer lives and earns income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.